Comprendre les tubes d'acier SSAW et leur rôle en Arabie Saoudite

23 mars 2025

Partager cet article

Introduction aux tubes en acier SSAW dans l'industrie pétrolière et gazière d'Arabie saoudite

La position de l'Arabie saoudite en tant que puissance énergétique mondiale repose largement sur des infrastructures robustes, les systèmes de pipelines servant littéralement de veines vitales à son industrie pétrolière et gazière. Soudés à l'arc submergé en spirale (SSAW) acier les tubes sont devenus un composant critique de ces infrastructures, offrant l'équilibre parfait entre résistance, durabilité et rentabilité que requiert l'environnement exigeant de l'Arabie saoudite.

Le vaste réseau de pipelines du Royaume s'étend sur des milliers de kilomètres à travers des terrains désertiques difficiles, reliant les sites d'extraction aux installations de traitement, aux raffineries et aux terminaux d'exportation. Ces pipelines doivent résister à des conditions extrêmes, y compris des fluctuations de température allant de la chaleur brûlante du jour aux nuits froides du désert, des environnements corrosifs et des opérations à haute pression.

Les tubes SSAW, fabriqués par soudage en spirale de bandes d'acier, sont devenus le choix privilégié pour de nombreux projets de pipelines de grand diamètre en Arabie saoudite. Leur procédé de fabrication unique permet une résistance exceptionnelle tout en offrant une flexibilité dans les spécifications de diamètre, les rendant idéaux pour les exigences variées de Saudi Aramco et d'autres opérateurs majeurs de la région.

Pourquoi les tubes SSAW sont critiques pour les infrastructures saoudiennes :

- Capacités de grand diamètre: Les besoins massifs de transport de pétrole et de gaz en Arabie saoudite nécessitent souvent des tubes de diamètres allant de 24 pouces à plus de 100 pouces, des spécifications que les tubes SSAW peuvent facilement satisfaire.

- Rapport coût-efficacité: Le procédé de soudage en spirale optimise l'utilisation de l'acier, réduisant les coûts en matériaux pour les grands projets – un facteur significatif pour les décisions d'investissement en infrastructures.

- Résistance à la pression: Les systèmes de pipelines saoudiens fonctionnent souvent sous haute pression, particulièrement pour le transport de pétrole, et les tubes SSAW offrent l'intégrité structurelle nécessaire.

- Adaptation aux conditions locales: La possibilité de fabriquer des tubes avec des épaisseurs de paroi variables permet une personnalisation en fonction des conditions spécifiques du sol et des exigences d'installation à travers le paysage géographique diversifié de l'Arabie saoudite.

L'importance d'infrastructures de pipelines de qualité ne saurait être surestimée dans un pays où les exportations d'hydrocarbures représentent environ 80 % des revenus nationaux. Alors que l'Arabie saoudite continue d'élargir sa capacité de production pétrolière et gazière dans le cadre des initiatives de Vision 2030, la demande de tubes SSAW de haute qualité croît proportionnellement.

Les professionnels de l'industrie ont observé que le choix des matériaux de pipeline appropriés impacte directement les délais des projets, la sécurité opérationnelle et les coûts de maintenance à long terme. Pour les projets saoudiens, où les retards peuvent coûter des millions de dollars par jour, sélectionner le bon fournisseur de tubes SSAW devient une décision d'importance stratégique.

Position actuelle sur le marché :

Ces dernières années, l'Arabie saoudite a investi massivement dans la diversification de ses fournisseurs d'infrastructures de pipelines, avec une préférence croissante pour les fabricants capables de démontrer :

- Une adhésion stricte aux normes internationales

- Des processus complets de contrôle qualité

- Une expérience avec des projets moyen-orientaux

- Une capacité à honorer de grandes commandes

- Un soutien technique tout au long du cycle de vie du projet

Alors que le Royaume poursuit ses ambitieux plans de développement des infrastructures, y compris l'expansion de la production de gaz et l'augmentation de la capacité pétrochimique, le rôle des tubes SSAW de qualité devient de plus en plus central pour les objectifs économiques nationaux.

Analyse de marché : Tendances de croissance et demande de tubes SSAW en Arabie saoudite

Le marché saoudien des tubes en acier SSAW a démontré une remarquable résilience et une forte croissance, même au milieu des fluctuations économiques mondiales. Cette section examine les dynamiques actuelles du marché, les projections futures et les principaux moteurs influençant la demande de tubes SSAW dans le secteur pétrolier et gazier du Royaume.

Taille actuelle du marché et projections :

Le marché des infrastructures de pipelines en Arabie saoudite était évalué à environ 2,1 milliards USD en 2022, les tubes SSAW représentant environ 35 % de cette valeur. Les analystes de l'industrie prévoient que ce segment croîtra à un TCAC de 6,8 % entre 2023 et 2030, atteignant potentiellement une valorisation de 3,5 milliards USD d'ici la fin de la décennie.

Cette trajectoire de croissance est alimentée par plusieurs développements majeurs dans le paysage pétrolier et gazier saoudien :

| Phase du projet | Investissement prévu (USD) | Besoin en tubes SSAW (tonnes) | Chronologie |

|---|---|---|---|

| Programme d'expansion gazière d'Aramco | 110 milliards $ | 850,000 | 2023-2030 |

| Développement du champ gazier de Jafurah | 6,6 milliards $ | 120,000 | 2023-2027 |

| Expansion du Master Gas System | 4 milliards $ | 300,000 | 2022-2026 |

| Augmentation de la capacité de l'East-West Pipeline | 2,1 milliards $ | 280,000 | 2023-2025 |

| Développement des champs de Marjan et Berri | 18 milliards $ | 200,000 | 2022-2025 |

Principaux moteurs du marché :

- Initiatives d'augmentation de la production de gaz: La stratégie de l'Arabie saoudite pour porter la production de gaz naturel de 14 milliards de pieds cubes standard par jour à 23 milliards d'ici 2027 nécessite un développement extensif des infrastructures de pipelines.

- Diversification au-delà du pétrole: Dans le cadre de Vision 2030, le Royaume étend ses infrastructures gazières pour réduire la dépendance au pétrole pour la production d'électricité domestique, créant une demande substantielle pour des tubes SSAW de grand diamètre.

- Développement des infrastructures hydriques: L'Arabie saoudite investit simultanément dans des systèmes de transport d'eau, les tubes SSAW étant le choix privilégié pour les grands projets de conveyance d'eau complétant les infrastructures pétrolières et gazières.

- Cycles de remplacement et de maintenance: Une grande partie des infrastructures de pipelines installées dans les années 1980 et 1990 approche de la fin de sa durée de vie opérationnelle, créant un marché de remplacement significatif.

- Initiatives de localisation: Le programme In-Kingdom Total Value Add (IKTVA) de Saudi Aramco encourage les partenariats de fabrication locale, créant des opportunités pour les fabricants internationaux de tubes SSAW d'établir des installations de production au sein du Royaume.

Tendances émergentes sur le marché :

Le marché saoudien des tubes SSAW connaît plusieurs tendances notables que les acheteurs en gros et distributeurs devraient surveiller :

- Exigences de qualités supérieures: On observe un virage croissant vers les tubes de qualité X70 et X80 pour les applications à haute pression, s'éloignant des qualités X60 et X65 précédemment courantes.

- Spécifications résistantes à la corrosion: Avec de nombreux pipelines opérant dans des environnements salins ou transportant du gaz acide, la demande pour une protection renforcée contre la corrosion via des revêtements et doublures spécialisés a considérablement augmenté.

- Numérisation des chaînes d'approvisionnement: Les grands projets saoudiens exigent désormais des fournisseurs qu'ils intègrent des systèmes de suivi numérique et d'assurance qualité, offrant un suivi en temps réel de la fabrication et de la livraison des tubes.

- Considérations sur le développement durable: Les évaluations d'impact environnemental influencent de plus en plus le choix des matériaux, avec une préférence pour les fournisseurs démontrant des pratiques de fabrication durables et une réduction de l'empreinte carbone.

Paysage concurrentiel :

L'environnement concurrentiel pour les fournisseurs de tubes SSAW en Arabie saoudite peut être classé en trois niveaux :

Niveau 1: Fabricants mondiaux avec des installations de production locales ou des partenariats solides (part de marché : environ 45 %)

Niveau 2: Fournisseurs internationaux avec des réseaux de distribution établis en Arabie saoudite (part de marché : environ 35 %)

Niveau 3: Nouveaux entrants offrant des prix compétitifs mais une présence locale limitée (part de marché : environ 20 %)

La répartition des parts de marché indique que les acheteurs accordent une grande valeur aux fournisseurs démontrant un engagement local associé à une assurance qualité – un équilibre que des entreprises comme WUZHOU ont réussi à atteindre grâce à leur approche complète du marché saoudien.

Considérations sur la chaîne d'approvisionnement :

Pour les acheteurs en gros et distributeurs, comprendre les dynamiques de la chaîne d'approvisionnement est crucial. Les délais actuels de livraison de tubes SSAW pour les projets saoudiens varient généralement de :

- 12-16 semaines pour les spécifications standard

- 16-24 semaines pour les exigences spécialisées ou les grandes commandes

Ces délais peuvent impacter significativement la planification des projets et soulignent l'importance de travailler avec des fournisseurs disposant d'une capacité de production constante et de réseaux logistiques fiables.

Spécifications techniques et normes requises pour les projets pétroliers et gaziers saoudiens

Répondre aux exigences techniques pour les tubes en acier SSAW dans les projets pétroliers et gaziers d'Arabie saoudite nécessite une compréhension complète des normes internationales et des spécifications spécifiques à l'Arabie saoudite. Cette section fournit aux acheteurs en gros et ingénieurs de projet des informations essentielles sur les paramètres techniques déterminant l'adéquation des tubes pour les projets saoudiens.

Normes Saudi Aramco et conformité internationale :

Saudi Aramco, principal opérateur pétrolier et gazier du Royaume, a développé ses propres normes d'ingénierie (SAES) qui dépassent souvent les exigences internationales. Les tubes SSAW pour les projets saoudiens doivent généralement se conformer à :

- SAES-L-105 (Tubes en acier pour pipelines)

- SAES-L-110 (Raccords pour pipelines)

- SAES-A-112 (Exigences d'inspection des matériaux)

- SAES-H-201 (Revêtements et doublures pour pipelines)

En plus de ces normes spécifiques à Aramco, les tubes SSAW doivent respecter les normes internationales, notamment :

- API 5L (Spécification de l'American Petroleum Institute pour les tubes de ligne)

- ISO 3183 (Industries du pétrole et du gaz naturel—Tubes en acier pour systèmes de transport par pipeline)

- ASTM A139/A139M (Spécification standard pour tubes en acier soudés par fusion électrique)

- AWWA C200 (Tubes en acier pour eau, 6 pouces et plus)

Paramètres techniques essentiels pour les projets saoudiens :

Les conditions d'exploitation difficiles en Arabie saoudite nécessitent une attention particulière aux spécifications techniques suivantes :

1. Exigences de qualité d'acier :

Les qualités d'acier les plus couramment spécifiées pour les projets pétroliers et gaziers saoudiens incluent :

| Type de projet | Grades d'acier courants | Limite d'élasticité (MPa) | Applications |

|---|---|---|---|

| Transport de pétrole à haute pression | X65, X70, X80 | 448-552, 483-621, 552-690 | Lignes principales de transport de pétrole, pipelines d'exportation |

| Transport de gaz | X60, X65 | 414-517, 448-552 | Distribution de gaz domestique, lignes d'approvisionnement industriel |

| Systèmes d'injection d'eau | X52, X56 | 359-455, 386-483 | Récupération secondaire de pétrole, maintien de pression |

| Lignes d'eau produite | L360, L415 | 360-460, 415-515 | Gestion de l'eau dans les installations de production, systèmes d'évacuation |

| Lignes multifluides | X65 (service acide) | 448-552 | Transport des puits aux installations de traitement |

2. Spécifications dimensionnelles :

Les projets saoudiens requièrent généralement des tubes SSAW dans ces plages de paramètres :

- Gamme de diamètres: 24″ (610 mm) à 100″ (2540 mm)

- Épaisseur de la paroi6mm à 25mm

- Longueur: 12 m ou 18 m (longueurs personnalisées disponibles pour applications spéciales)

- Rectitude: Déviation maximale de 0,2 % de la longueur totale

- L'absence d'arrondi: Maximum de 1 % du diamètre extérieur nominal

3. Exigences de soudage et de fabrication :

L'intégrité des soudures spiralées est primordiale pour les projets saoudiens, avec des spécifications incluant généralement :

- Procédé de double soudage à l'arc submergé (DSAW)

- Inspection radiographique ou ultrasonique à 100 % des soudures

- Résistance des soudures égale ou supérieure à celle du métal de base

- Dureté de la zone affectée par la chaleur inférieure à 248 HV10 pour service acide

- Procédés de soudage automatisés avec surveillance continue

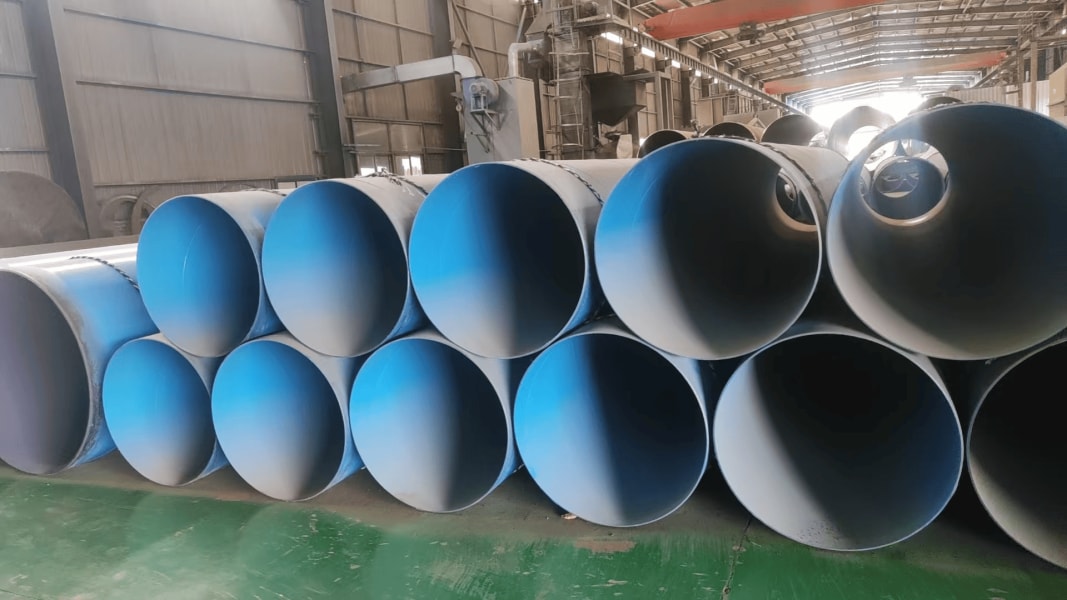

4. Revêtement et protection contre la corrosion :

Les conditions du sol et les hautes températures en Arabie saoudite nécessitent des systèmes de revêtement spécialisés :

| Type de revêtement | Application | Épaisseurs requises | Avantages pour les conditions saoud |

|---|---|---|---|

| Polyéthylène à trois couches (3LPE) | Protection externe pour pipelines enterrés | 2,5 mm – 3,5 mm | Excellente |

| Époxy fusionné (FBE) | Protection externe, souvent comme apprêt | 350 μm – 500 μm | Bonne adhésion, résistance chimique |

| Epoxy liquide | Protection interne | 400 μm – 600 μm | Empêche la corrosion interne, réduit les frottements |

| Revêtement en mortier de ciment | Protection interne pour les conduites d’eau | 6 mm – 12 mm | Empêche la corrosion interne et la tuberculation |

| Revêtements polyuréthane | Protection externe pour conditions extrêmes | 1500 μm – 2500 μm | Résistance supérieure à l’abrasion et aux chocs |

5. Exigences en matière d’essais :

Les projets saoudiens exigent généralement des essais complets, incluant :

- Essais hydrostatiques : À 1,5 fois la pression de conception pendant un minimum de 10 secondes

- Essais des propriétés mécaniques : Essais de traction, d’impact et de dureté

- Analyse de la composition chimique : Vérification de l’équivalent carbone et de la teneur en alliage

- Examen non destructif (END) : Essais ultrasonores, radiographiques, inspection par particules magnétiques

- Essais d’adhésion du revêtement : Essais de traction avec une résistance à l’adhésion minimale de 15 MPa

- Essai de flexion : Pour l’évaluation des soudures et l’évaluation de la ductilité

6. Documentation et certification :

Les projets pétroliers et gaziers arabes saoudiens exigent une documentation complète, incluant :

- Rapports d’essais des matériaux (MTR) pour chaque lot

- Plans de processus de fabrication (MPP)

- Plans d’inspection et d’essais (ITP)

- Spécifications des procédures de soudage (WPS)

- Registres de qualification des procédures (PQR)

- Rapports d’essais non destructifs (NDT)

- Certificats d’inspection par tiers

- Documentation sur la traçabilité des matériaux

Exigences spécialisées pour le service acide :

De nombreux champs gaziers arabes saoudiens contiennent du sulfure d’hydrogène (H₂S), nécessitant que les tuyaux SSAW respectent des spécifications supplémentaires pour service acide :

- Conformité NACE MR0175/ISO 15156

- Limitations de dureté (généralement maximum 22 HRC)

- Valeurs d’équivalent carbone restreintes (< 0,43 %)

- Essais renforcés de résistance à la fissuration

- Procédures de soudage spécialisées pour prévenir la fissuration par contrainte sulfurée

Considérations relatives à l’assurance qualité :

Pour les acheteurs en gros et distributeurs approvisionnant des tuyaux SSAW pour les projets saoudiens, les processus d’assurance qualité sont aussi importants que les spécifications techniques. Les fournisseurs doivent démontrer :

- Certification ISO 9001 de management qualité

- Certification API Q1 pour la gestion qualité pétrole et gaz

- Capacités d’essais internes pour tous les essais requis

- Arrangements d’inspection par tiers avec des agences approuvées

- Systèmes de traçabilité complète de la fabrication

- Procédures de contrôle qualité documentées pour chaque étape de production

WUZHOU se distingue par sa capacité à répondre à ces exigences techniques exigeantes grâce à ses processus de fabrication avancés et à ses systèmes complets de contrôle qualité. Leurs tuyaux en acier spiralés sont fabriqués selon des normes internationales en utilisant des nuances d’acier premium, assurant la conformité aux spécifications strictes de Saudi Aramco. Leur certification API 5L et leur système de gestion qualité ISO 9001 offrent une assurance supplémentaire aux chefs de projet et spécialistes en approvisionnement à la recherche de fournisseurs fiables pour les projets pétroliers et gaziers arabes saoudiens.

Comparaison des tuyaux SSAW avec des solutions alternatives de canalisations pour les conditions du Moyen-Orient

Lors de la planification des infrastructures pétrolières et gazières dans l’environnement difficile de l’Arabie saoudite, les chefs de projet doivent évaluer attentivement diverses solutions de canalisations par rapport aux tuyaux en acier SSAW. Cette comparaison est essentielle pour prendre des décisions d’approvisionnement éclairées qui équilibrent performance, coût et fiabilité à long terme.

Tuyaux SSAW c. Tuyaux soudés longitudinalement (LSAW) :

Les tuyaux SSAW et LSAW sont couramment envisagés pour les applications à grand diamètre dans les projets arabes saoudiens, mais ils offrent des avantages différents :

| Caractéristique | Tubes SSAW | Tubes LSAW | Pertinence pour les projets saoudiens |

|---|---|---|---|

| Méthode de fabrication | Soudage en spirale de bande d’acier | Soudage longitudinal de plaque d’acier | Les SSAW offrent une utilisation plus efficace des matériaux |

| Gamme de diamètres | 24″ à 120″ | 16″ à 60″ | Les SSAW mieux adaptés aux grandes lignes principales |

| Épaisseur de la paroi | 6mm à 25mm | 6 mm à 40 mm | Les LSAW préférés pour ultra-haute pression |

| Rapport coût-efficacité | Efficacité matérielle supérieure | Coût des matériaux plus élevé | Les SSAW offrent 10-15 % d’économies de coûts |

| Vitesse de production | Cycles de production plus rapides | Processus de production plus lent | Les SSAW mieux adaptés aux délais serrés des projets |

| Longueur de la soudure | Soudure plus longue par longueur de tuyau | Soudure plus courte par longueur de tuyau | Les LSAW présentent moins de points de défaillance potentiels |

| Pression nominale | Jusqu’au grade X80 | Jusqu’au grade X100 | Les SSAW suffisants pour la plupart des applications saoudiennes |

| Part de marché en Arabie saoudite | 65 % des applications à grand diamètre | 30 % des applications à grand diamètre | SSAW est le choix dominant |

Pour la plupart des applications de lignes principales en Arabie saoudite, les tubes SSAW offrent l’équilibre optimal entre coût, efficacité de fabrication et caractéristiques de performance. Cependant, pour les applications spécialisées à haute pression dépassant 120 bars, les tubes LSAW peuvent être préférés malgré leur coût plus élevé.

Tubes SSAW vs tubes sans soudure :

Les tubes sans soudure sont produits sans soudage, offrant certains avantages pour des applications spécifiques :

| Caractéristique | Tubes SSAW | Tubes sans soudure | Pertinence pour les projets saoudiens |

|---|---|---|---|

| Méthode de fabrication | Soudage en spirale de bande d’acier | Procédé d’extrusion ou de perforage | Les tubes sans soudure n’ont pas de problèmes d’intégrité liés aux soudures |

| Gamme de diamètres | 24″ à 120″ | Jusqu’à 26 po | SSAW indispensable pour les lignes principales à grand diamètre |

| Résistance à la pression | Bon à excellent | Supérieure | Sans soudure préférés pour les applications à très haute pression |

| Coût | Coût par mètre inférieur | Coût supérieur de 40-60 % | SSAW offre des économies significatives sur les coûts du projet |

| Résistance à la corrosion | Bon avec un revêtement approprié | Excellent | Sans soudure meilleur pour les environnements hautement corrosifs |

| Capacité de production | Capacité de production élevée | Capacité limitée pour les grands diamètres | SSAW mieux adapté aux grands projets saoudiens |

| Applications en Arabie saoudite | Lignes principales de transmission | Gainages de puits, connexions critiques | Cas d’utilisation différents dans le secteur pétrolier et gazier saoudien |

Bien que les tubes sans soudure offrent une résistance supérieure à la pression et à la corrosion, leurs limitations en diamètre et leur coût nettement plus élevé les rendent impraticables pour les grandes lignes de transmission qui forment l’épine dorsale de l’infrastructure pétrolière et gazière d’Arabie saoudite.

Tubes SSAW vs tubes composites :

Les technologies plus récentes de tubes composites et de tubes thermoplastiques renforcés (RTP) sont parfois envisagées pour les projets saoudiens :

| Caractéristique | Tubes SSAW | Tubes composites/RTP | Pertinence pour les projets saoudiens |

|---|---|---|---|

| Composition des matériaux | Acier au carbone | Matrice polymère avec renforcement par fibres | L’acier supporte mieux les températures extrêmes saoudiennes |

| Tolérance de température | -45 °C à 150 °C | -20 °C à 65 °C | SSAW supérieur face aux fluctuations de température désertique |

| Résistance aux UV | Excellente avec un revêtement approprié | Capacité limitée d’exposition à long terme | Critique pour les sections en surface en Arabie saoudite |

| Résistance à la corrosion | Nécessite un revêtement protecteur | Résistance à la corrosion inhérente | Avantage des composites dans les environnements corrosifs |

| Coût de l'installation | Coût d’installation plus élevé | Coût d’installation inférieur de 30-40 % | Les composites offrent des avantages en matière d’installation |

| Durée de vie attendue | 30-50 ans | 20-30 ans prouvés | SSAW offre un historique de service à long terme supérieur |

| Acceptation en Arabie saoudite | Largement approuvé | Approbation limitée pour les applications critiques | La familiarité réglementaire favorise SSAW |

| Coût | Coût du matériau inférieur | Coût des matériaux plus élevé | La comparaison des coûts totaux dépend des spécificités du projet |

Bien que les tubes composites offrent des avantages en résistance à la corrosion, leur tolérance limitée aux températures, leurs performances à long terme non prouvées dans les conditions désertiques et leur acceptation réglementaire restreinte font des tubes SSAW le choix préféré pour les grands projets de transmission pétrolière et gazière en Arabie saoudite.

Comparaison de l’impact environnemental :

Avec l’accent croissant mis par l’Arabie saoudite sur la durabilité dans le cadre de sa Vision 2030, les considérations environnementales deviennent plus importantes dans le choix des matériaux pour les pipelines :

| Facteur environnemental | Tubes SSAW | Alternatives | Impact sur la durabilité |

|---|---|---|---|

| Empreinte carbone | 2,1-2,3 tonnes de CO₂ par tonne de tube | Composite : 2,8-3,2 tonnes de CO₂ par tonne | SSAW présente des émissions de fabrication plus faibles |

| Consommation d’énergie | 18-22 GJ par tonne | LSAW : 20-25 GJ par tonne | SSAW offre une efficacité énergétique modeste |

| Recyclabilité | Entièrement recyclable (> 95 %) | Composites : Recyclabilité limitée | SSAW supérieur en termes de durabilité en fin de vie |

| Restauration des terrains | Pratiques standard de restauration | Exigences similaires | Impact environnemental comparable |

| Consommation d’eau | Consommation d’eau modérée | Composites : Consommation d’eau plus faible | La conservation de l’eau favorise les composites |

| Lessivage chimique | Aucun avec un revêtement approprié | Risque de lessivage polymère avec les composites | SSAW plus sûr pour la protection des eaux souterraines |

En tenant compte de l’impact environnemental sur l’ensemble du cycle de vie, les tubes SSAW offrent une solution plus durable pour les projets saoudiens, notamment grâce à leur empreinte carbone plus faible, leur recyclabilité complète et leur bilan prouvé en matière de sécurité environnementale.

Performance dans les conditions spécifiques de l’Arabie saoudite :

Les défis uniques de l’environnement saoudien nécessitent une attention particulière :

- Fluctuations extrêmes de température: Les variations quotidiennes de température pouvant atteindre 30 °C exigent des matériaux dotés d’excellentes propriétés de dilatation thermique. Les tubes SSAW avec des joints de dilatation bien conçus surpassent les alternatives à cet égard.

- Abrasion par le sable: Le sable transporté par le vent peut causer une abrasion externe des pipelines. Les tubes SSAW munis de revêtements protecteurs appropriés ont démontré une résistance supérieure à long terme.

- Eaux souterraines salines: De nombreuses régions saoudiennes présentent une forte salinité des eaux souterraines. Bien que les tubes composites offrent une résistance à la corrosion inhérente, les tubes SSAW correctement revêtus et équipés de systèmes de protection cathodique se sont révélés tout aussi efficaces à un coût inférieur.

- Considérations sismiques: Certaines parties de l’Arabie saoudite connaissent une activité sismique mineure. La construction à soudure spirale des tubes SSAW offre une excellente flexibilité et une bonne répartition des contraintes dans de telles conditions.

Compte tenu de ces comparaisons, les tubes SSAW provenant de fabricants fiables comme WUZHOU représentent la solution optimale pour la plupart des applications de transmission pétrolière et gazière à grand diamètre en Arabie saoudite, offrant le meilleur équilibre entre rentabilité, fiabilité des performances et compatibilité avec les conditions locales.

Top 5 des considérations pour sélectionner un fournisseur de tubes en acier SSAW pour les projets saoudiens

Sélectionner le bon fournisseur de tubes en acier SSAW pour les projets pétroliers et gaziers en Arabie saoudite est une décision critique qui impacte les délais du projet, les coûts et la fiabilité à long terme de l’infrastructure. Cette section présente les cinq facteurs les plus importants que les professionnels des achats et les chefs de projet devraient prendre en compte lors de l’évaluation des fournisseurs potentiels.

1. Capacités de fabrication et systèmes de contrôle qualité

La base de toute relation d’approvisionnement fiable en tubes SSAW repose sur les capacités de production du fabricant et ses processus d’assurance qualité.

Principales capacités de fabrication à évaluer :

- Capacité de production: Les fournisseurs doivent démontrer une capacité de production suffisante pour répondre aux besoins du projet sans compromettre la qualité. WUZHOU, avec ses 11 lignes de production avancées de tubes spirales et une production annuelle de 400 000 tonnes, illustre l’échelle nécessaire pour les grands projets saoudiens.

- Technologie de fabrication: Des équipements de laminoir spiralé avancés avec des systèmes de soudage automatisés garantissent une qualité de soudure constante et une précision dimensionnelle. Les installations modernes avec des processus de fabrication contrôlés par ordinateur produisent généralement des tubes plus fiables.

- Installations de tests internes: Des capacités de test complètes pour les propriétés mécaniques, les examens non destructifs et les tests hydrostatiques sont essentielles. Les processus complets d’inspection qualité de WUZHOU, incluant des tests de pression par l’eau, des tests ultrasonores et des examens par rayons X, exemplifient le contrôle qualité approfondi requis pour les projets Saudi Aramco.

Systèmes de contrôle qualité à vérifier :

| Composant du système qualité | Exigences minimales | Norme de classe mondiale (comme WUZHOU) |

|---|---|---|

| Certification de gestion qualité | Certification ISO 9001 | ISO 9001, ISO 14001, certification API 5L |

| Inspection des matières premières | Vérification de la composition des matériaux | Traçabilité complète avec rapports détaillés sur les matériaux |

| Contrôle qualité des soudures | Inspection visuelle et END ponctuelle | END automatisée à 100 % sur toutes les soudures |

| Contrôle dimensionnel | Mesures manuelles | Systèmes de surveillance continue par laser |

| Essais hydrostatiques | Tests de pression standard | Tests de pression surveillés par ordinateur avec enregistrement des données |

| Inspection du revêtement | Tests visuels et d’épaisseur | Tests avancés d’adhérence et de détection de défauts |

| Documentation | Certificats de matériau de base | Dossiers qualité complets avec traçabilité intégrale |

Signaux d’alarme à surveiller :

- Réticence à autoriser des inspections par des tiers

- Résultats de tests incohérents entre tests internes et tiers

- Documentation limitée des processus qualité

- Historique de rejets liés à la qualité sur des projets précédents

2. Conformité aux exigences spécifiques saoudiennes et aux normes internationales

Les projets saoudiens opèrent dans un cadre réglementaire unique combinant normes internationales et exigences spécifiques de Saudi Aramco.

Domaines de conformité critiques :

- Conformité API 5L: La certification selon les normes API 5L est obligatoire pour les pipelines pétroliers et gaziers en Arabie saoudite. Les tubes de WUZHOU ont passé la certification API 5L, garantissant qu’ils respectent les exigences strictes de l’American Petroleum Institute.

- Statut de fabricant approuvé par Saudi Aramco: Être inscrit sur la liste des fabricants approuvés de Saudi Aramco simplifie considérablement les processus d’approbation des projets. Ce statut indique que le fabricant a précédemment fourni des matériaux conformes aux normes exigeantes d’Aramco.

- Conformité SAES: La connaissance des normes d’ingénierie Saudi Aramco (SAES) spécifiques aux matériaux de pipeline est essentielle. Les fournisseurs doivent démontrer leur compréhension de ces exigences et disposer de processus pour en assurer le respect.

- Traçabilité des matériaux: Les projets saoudiens exigent généralement une traçabilité complète des matériaux depuis la production de l’acier jusqu’à la fabrication des tubes. Les fournisseurs doivent maintenir des systèmes de documentation complets satisfaisant aux exigences de vérification des matériaux de Saudi Aramco.

Exigences documentaires :

Les fournisseurs doivent être en mesure de fournir des packages de documentation complets incluant :

- Rapports d’essai des matériaux (MTR) avec propriétés chimiques et mécaniques

- Plans de processus de fabrication (MPP)

- Plans d’inspection et d’essais (ITP)

- Rapports d’examen non destructif (END)

- Rapports d'inspection du revêtement

- Certificats d’inspection par tiers

- Documentation des procédures de soudage

Certifications internationales importantes :

Bien que les exigences saoudiennes spécifiques soient primordiales, les certifications internationales apportent une assurance supplémentaire de qualité :

- Systèmes de management de la qualité ISO 9001

- Systèmes de management environnemental ISO 14001

- OHSAS 18001/ISO 45001 Santé et sécurité au travail

- API Q1 Management de la qualité pour l'industrie pétrolière et gazière

3. Antécédents et expérience de projets au Moyen-Orient

L'historique d'un fournisseur en matière d'exécution réussie de projets en Arabie saoudite et dans l'ensemble de la région du Moyen-Orient fournit des indications précieuses sur sa fiabilité et sa capacité à surmonter les défis régionaux.

Éléments d'antécédents à évaluer :

- Projets antérieurs en Arabie saoudite: Les fournisseurs ayant un historique de livraisons réussies à Saudi Aramco, SABIC ou d'autres grands opérateurs saoudiens démontrent leur familiarité avec les exigences locales.

- Références régionales: Les retours d'autres clients de la région peuvent fournir des indications sur les performances, la fiabilité et les capacités de résolution de problèmes d'un fournisseur.

- Expérience en projets complexes: Les fournisseurs doivent démontrer une expérience avec des projets de complexité similaire ou supérieure à vos exigences actuelles.

- Indicateurs de performance: Demander des données sur :

- Performance de livraison à temps sur les projets précédents

- Taux de rejet sur les livraisons antérieures en Arabie saoudite

- Délai de réponse aux demandes techniques

- Historique des réclamations de garantie

Évaluation d'études de cas :

Demander des études de cas détaillées sur les projets saoudiens ou moyen-orientaux les plus pertinents du fournisseur, en analysant :

- Portée et échelle de l'approvisionnement

- Défis techniques surmontés

- Performance en termes de délais

- Performance qualité

- Support post-livraison fourni

Défis courants dans les projets saoudiens :

Les fournisseurs expérimentés au Moyen-Orient ont développé des solutions pour les défis régionaux tels que :

- Gestion des fluctuations extrêmes de température pendant le transport et l'installation

- Navigation dans les procédures d'importation aux ports saoudiens

- Coordination avec les équipes d'inspection de Saudi Aramco

- Adaptation aux modifications de spécifications de dernière minute

- Compréhension des pratiques commerciales locales et des protocoles de communication

4. Capacités logistiques et résilience de la chaîne d'approvisionnement

La capacité à livrer des tuyaux SSAW aux sites de projets saoudiens de manière efficace et fiable est aussi importante que la qualité de fabrication. Les défis logistiques peuvent entraîner des retards coûteux si ils ne sont pas gérés correctement.

Capacités logistiques à évaluer :

- Dispositions en matière de transport: Les fournisseurs doivent avoir des relations établies avec des entreprises spécialisées dans le transport lourd familières des réglementations et opérations portuaires saoudiennes.

- Expérience en expédition: L'expérience en expédition en vrac vers les ports saoudiens (Dammam, Jubail, Djeddah) et la compréhension des procédures douanières locales sont précieuses.

- Solutions de stockage: Certains projets nécessitent des livraisons échelonnées avec stockage intermédiaire. Les fournisseurs capables d'offrir ou d'organiser des installations de stockage sécurisées en Arabie saoudite apportent une flexibilité supplémentaire.

- Expertise en documentation: La familiarité avec les exigences de documentation d'importation saoudienne évite les retards douaniers.

Facteurs de résilience de la chaîne d'approvisionnement :

| Facteur de résilience | Exigences de base | Capacités renforcées |

|---|---|---|

| Approvisionnement en matières premières | Fournisseurs d'acier établis | Multiples sources d'acier qualifiées avec accords de capacité |

| Flexibilité de la production | Capacité à ajuster les calendriers de production | Multiples lignes de production capables de fabriquer les mêmes spécifications |

| Options de transport | Arrangements d'expédition standards | Multiples itinéraires et modes de transport avec plans de contingence |

| Gestion des stocks | Fabrication juste-à-temps | Stock stratégique de matières premières et composants clés |

| Gestion des risques | Évaluation des risques de base | Plan de gestion des risques complet avec stratégies d'atténuation |

Considérations sur les délais de livraison :

Pour les projets saoudiens, les délais typiques incluent :

- 4-6 semaines pour l'approvisionnement en matières premières

- 6-8 semaines pour la fabrication

- 3-5 semaines pour l'application de revêtement

- 4 à 6 semaines pour l'expédition et le dédouanement

Les fournisseurs capables d'optimiser ces délais sans compromettre la qualité offrent des avantages substantiels pour la planification des projets.

5. Support technique et service après-vente

La relation avec un fournisseur de tubes SSAW s'étend au-delà de la livraison, particulièrement pour les projets pétroliers et gaziers complexes en Arabie saoudite où le soutien à l'installation et les capacités de résolution de problèmes sont essentiels.

Éléments de support technique :

- Consultation préalable à la commande: Les fournisseurs qualifiés fournissent des conseils techniques pendant la phase de développement des spécifications, aidant à optimiser le choix des matériaux et les paramètres de conception adaptés aux conditions saoudiennes.

- Documentation technique: Des directives complètes sur la manutention, le stockage et l'installation spécifiques aux conditions arabes saoudiennes doivent être fournies.

- Soutien technique sur site: La capacité à déployer des experts techniques sur les sites de projets saoudiens pour des consultations ou une résolution de problèmes témoigne d'un engagement envers le succès du projet.

- Assistance technique en soudage: Soutien pour les procédures de soudage sur site, incluant des recommandations sur les procédés de soudage adaptés aux conditions climatiques saoudiennes.

Considérations pour le service après-vente :

- Conditions de garantie: Des conditions de garantie claires et complètes couvrant les défauts de fabrication et les performances des revêtements.

- Protocoles d'intervention: Des procédures établies pour répondre aux questions techniques ou aux préoccupations de qualité, avec des délais de réponse garantis.

- Capacité d'approvisionnement en pièces de rechange/remplacement: Capacité à expédier rapidement des tubes de remplacement en cas de dommages pendant l'installation ou de conditions imprévues sur site.

- Approche de relation à long terme: La preuve d'un soutien continu aux clients saoudiens précédents au-delà des périodes de garantie démontre un engagement envers la satisfaction client.

Services à valeur ajoutée à rechercher :

- Programmes de formation pour le personnel client sur la manutention et l'installation des tubes

- Séminaires techniques sur la maintenance et la gestion de l'intégrité des pipelines

- Systèmes de suivi numérique pour un suivi en temps réel des expéditions

- Systèmes de gestion de documentation facilitant les processus d'approbation de Saudi Aramco

WUZHOU incarne nombre de ces meilleures pratiques grâce à son approche complète de soutien client, qui inclut des rapports détaillés d'inspection des matériaux et de la qualité, une assistance technique réactive et un historique de réalisation réussie de projets. Ses installations de production ultramodernes et ses processus rigoureux de contrôle qualité lui ont valu une reconnaissance en tant que « Top 10 Chinese Brand of Steel Pipe », faisant de lui un partenaire fiable pour les projets pétroliers et gaziers exigeants en Arabie saoudite.

WUZHOU : Leader de la fabrication de tubes en acier SSAW pour l'infrastructure arabie-saoudienne

Dans le paysage concurrentiel de la fabrication de tubes en acier SSAW, WUZHOU s'est imposé comme un fournisseur de premier plan pour les projets d'infrastructure pétrolière et gazière en Arabie saoudite. Cette section examine comment les capacités, les normes de qualité et l'expertise régionale de WUZHOU le positionnent comme un partenaire idéal pour les exigences exigeantes en pipelines de l'Arabie saoudite.

Contexte de l'entreprise et excellence de la fabrication

WUZHOU représente la marque phare du groupe Cangzhou Spiral Steel Pipes, une entreprise dotée d'une histoire distinguée dans la fabrication spécialisée de tubes. Sa concentration sur des tubes en acier spiralés de haute qualité la rend particulièrement adaptée aux projets d'infrastructure pétrolière, gazière, hydraulique et électrique en Arabie saoudite.

Infrastructure de fabrication :

Les capacités de production de WUZHOU sont parmi les plus complètes de l'industrie :

- Capacité de production: Avec 13 lignes de production avancées — 11 dédiées aux tubes en acier spiralés et 2 spécialisées dans le revêtement et le doublage —, WUZHOU maintient une capacité de production annuelle de 400 000 tonnes de tubes soudés en spirale.

- Installations de fabrication: L'entreprise exploite 3 filiales, 2 usines et 4 bases de production réparties sur 6 ateliers, offrant une redondance de fabrication qui garantit une fiabilité constante de la chaîne d'approvisionnement — un facteur critique pour les projets arabes saoudiens aux délais stricts.

- Capacités techniques: Le procédé de soudage à l'arc submergé en spirale de WUZHOU représente la référence de l'industrie pour la production de tubes de grand diamètre, offrant la précision dimensionnelle et l'intégrité des soudures requises pour les projets Saudi Aramco.

Système d'assurance qualité :

L'engagement de WUZHOU envers la qualité est évident à travers son approche multicouche de contrôle qualité :

| Élément de contrôle qualité | WUZHOU Mise en œuvre | Avantage pour les projets saoudiens |

|---|---|---|

| Sélection des matières premières | Approvisionnement en nuances d'acier premium avec tests complets des matériaux | Garantit que les tubes respectent les exigences strictes en matériaux de Saudi Aramco |

| Contrôles des processus de fabrication | Production contrôlée par ordinateur avec surveillance continue | Maintient une consistance dimensionnelle pour les commandes de grand volume |

| Assurance qualité des soudures | 100% contrôle automatisé par ultrasons de toutes les soudures | Élimine le risque de défauts de soudure dans les systèmes de pipeline critiques |

| Essais hydrostatiques | Tests de pression monitorés par ordinateur sur chaque tube | Vérifie l'intégrité sous pression selon les normes de performance saoudiennes |

| Contrôle de la qualité du revêtement | Tests d'épaisseur multipoints et détection de vacances | Assure une protection contre la corrosion dans l'environnement hostile d'Arabie saoudite |

| Documentation | Dossiers qualité complets avec traçabilité intégrale | Facilite les processus d'approbation et d'acceptation de Saudi Aramco |

| Certification | ISO 9001, ISO 14001, certification API 5L | Répond à toutes les exigences de qualification pour les projets saoudiens |

La philosophie d'assurance qualité de WUZHOU se reflète dans son approche pour chaque tube fabriqué : « De la sélection des matières premières à l'achèvement de la production, nous assurons la qualité de chaque tube soudé en spirale. » Cet engagement est démontré par des protocoles d'inspection complets incluant des tests de pression hydraulique, des examens ultrasonores et des inspections radiographiques sur chaque tube produit.

Gamme de produits et spécifications techniques pour les exigences saoudiennes

WUZHOU propose une gamme complète de tubes en acier spiralés spécifiquement adaptés aux exigences variées des projets d'infrastructure arabes saoudiens :

Spécifications standard :

- Gamme de diamètres: 219 mm à 3500 mm (8 à 138 pouces)

- Épaisseur de la paroi6mm à 25mm

- Grades d'acier: X42 à X80 (API 5L), L245 à L555 (ISO 3183)

- Longueur du tuyau: Standard 12 m et 18 m, avec longueurs personnalisées disponibles

- Processus de soudage: Soudage à l'arc submergé double face

Offres spécialisées pour les projets saoudiens :

- Tubes pour service haute température:

- Chimie de l'acier renforcée pour les fluctuations extrêmes de température courantes dans les déserts saoudiens

- Systèmes de revêtement spéciaux résistants à des températures jusqu'à 120 °C

- Idéal pour les sections de pipeline exposées dans les régions les plus chaudes d'Arabie saoudite

- Applications du service de l'aigreur:

- Matériaux conformes à NACE MR0175/ISO 15156

- Résistance renforcée à la fissuration induite par l'hydrogène (HIC)

- Essentiel pour les champs de gaz acide d'Arabie saoudite et les pipelines associés

- Lignes de transmission à haute pression:

- Options de nuances X70 et X80 pour applications haute pression

- Systèmes de revêtements renforcés pour conduites haute pression enterrées

- Optimisé pour l'infrastructure principale de transport pétrolier de Saudi Aramco

- Systèmes de transport d'eau:

- Revêtements internes certifiés pour eau potable

- Protection renforcée contre la corrosion externe dans conditions de sols salins

- Soutien à l'infrastructure hydraulique critique d'Arabie saoudite aux côtés des réseaux pétroliers et gaziers

Options de revêtements et de doublages :

Les lignes de production dédiées aux revêtements et doublages de WUZHOU proposent des systèmes de protection spécialisés conçus pour l'environnement exigeant d'Arabie saoudite :

| Type de revêtement/doublure | Application | Avantages pour les projets saoudiens |

|---|---|---|

| Polyéthylène à 3 couches (3LPE) | Revêtement externe pour pipelines enterrés | Protection supérieure dans les sols salins d'Arabie saoudite |

| Époxy lié par fusion (FBE) | Revêtement externe | Excellente résistance thermique pour conditions désertiques |

| Revêtement en polyuréthane | Revêtement externe pour applications spéciales | Résistance accrue à l'abrasion pour installation en terrain rocailleux |

| Revêtement en mortier de ciment | Doublage interne pour pipelines d'eau | Empêche la corrosion dans les applications d'eau potable |

| Revêtement époxy | Doublage interne pour pipelines pétroliers et gaziers | Réduit les frottements et prévient la corrosion interne |

| Double couche FBE | Revêtement externe pour applications haute température | Maintient l'intégrité sous cycles thermiques extrêmes |

Références en Arabie saoudite et au Moyen-Orient

WUZHOU s'est imposé sur le marché saoudien grâce à l'exécution réussie de nombreux projets de pipelines dans les secteurs pétrolier, gazier et hydraulique du Royaume.

Exemples notables de projets saoudiens :

- Extension du réseau de transport de gaz de la province orientale:

- Fourniture de 250 km de tubes SSAW de 48 pouces en nuance X65

- Conformité totale aux spécifications de Saudi Aramco

- Taux de rejet nul et livraison à temps

- Système de revêtement optimisé pour le désert

- Système de transport d'eau de la région occidentale:

- 180 km de tubes de grand diamètre pour transport d'eau

- Doublage en mortier de ciment avec revêtement externe 3LPE

- Conception personnalisée selon les exigences de Saudi Water Partnership Company

- Livraison accélérée pour respecter l'échéance critique d'infrastructure

- Système de collecte pétrolière de la région centrale:

- Tubes en nuance X60 conformes au service acide

- Système de revêtement renforcé pour enfouissement désertique

- Soutien technique pendant la phase d'installation

- Solution logistique spécialisée pour livraison sur site isolé

Expérience régionale au Moyen-Orient :

Au-delà de l'Arabie saoudite, WUZHOU a réalisé des projets majeurs de pipelines dans toute la région, démontrant sa compréhension des conditions et exigences locales :

- Extension du réseau de distribution de gaz aux Émirats arabes unis

- Système de pipelines d'exportation pétrolière au Koweït

- Infrastructure de transport d'eau à Oman

- Système de recirculation d'eau industrielle au Qatar

Cette expérience régionale apporte des enseignements précieux sur les aspects logistiques, techniques et réglementaires pour mener à bien des projets dans la région du Conseil de coopération du Golfe (CCG), au bénéfice direct des opérations en Arabie saoudite.

Avantages logistiques pour les projets saoudiens

WUZHOU a développé des solutions logistiques spécialisées pour le marché saoudien, répondant aux défis uniques de la livraison de tubes de grand diamètre sur les sites de projets du Royaume :

Dispositions d'expédition stratégiques :

- Relations établies avec des navires de levage lourd spécialisés pour le transport de tubes de grand diamètre

- Schémas de chargement optimisés maximisant la capacité tout en protégeant les tubes

- Coordination avec les autorités portuaires saoudiennes pour accélérer les procédures douanières

- Systèmes de suivi des expéditions en temps réel accessibles aux parties prenantes

Capacités logistiques intra-Royaume :

- Partenariats avec les principaux fournisseurs logistiques saoudiens pour le transport terrestre

- Équipements spécialisés de manutention des tubes pour éviter les dommages lors du déchargement et de la livraison sur site

- Zones d'entreposage stratégique près des principaux corridors de projets

- Planification de livraisons juste-à-temps adaptée aux calendriers de projets

Documentation et conformité :

- Compréhension complète des exigences documentaires d'importation saoudiennes

- Procédures d'expédition préapprouvées conformes aux attentes des douanes saoudiennes

- Documentation de certification des matériaux selon les normes de Saudi Aramco

- Systèmes de documentation électronique facilitant le traitement douanier accéléré

Services à valeur ajoutée pour les clients saoudiens

WUZHOU se distingue par une approche globale du support client spécifiquement adaptée aux exigences des projets en Arabie saoudite :

Services de support technique :

- Représentants techniques dédiés dotés d'une expérience dans les projets saoudiens

- Assistance technique sur site pendant les phases critiques de l'installation

- Recommandations de procédures de soudage optimisées pour les conditions de terrain saoudiennes

- Consultations en ingénierie pour des applications spéciales ou des environnements d'installation difficiles

Paquet de documentation sur la qualité :

Pour chaque expédition vers des projets saoudiens, WUZHOU fournit une documentation complète incluant :

- Rapports d'essais des matériaux avec propriétés chimiques et mécaniques complètes

- Registres des processus de production avec traçabilité complète de la fabrication

- Rapports d'inspection documentant l'ensemble des essais réalisés

- Documentation d'inspection des revêtements avec résultats d'essais et paramètres d'application

- Certificats d'inspection de tiers émis par des organismes internationaux reconnus

Support après-vente :

- Protocoles de réponse établis pour les demandes techniques avec réponse initiale garantie sous 24 heures

- Support de garantie avec représentation sur place dans le Royaume

- Examens et consultations sur les performances post-installation

- Approche de gestion de relations à long terme avec des représentants de comptes dédiés

Transfert de connaissances et formation :

- Formation sur les meilleures pratiques d'installation pour le personnel des entrepreneurs

- Directives pour la manutention et le stockage des tuyaux adaptées aux conditions climatiques saoudiennes

- Séminaires techniques sur la gestion et la maintenance de l'intégrité des pipelines

- Partage de connaissances issues de projets similaires dans la région

Avantages concurrentiels de WUZHOU pour les projets saoudiens

Par rapport à d'autres fournisseurs internationaux, WUZHOU offre plusieurs avantages distincts pour les projets pétroliers et gaziers en Arabie saoudite :

- Spécialisation de la fabrication: Contrairement aux entreprises sidérurgiques diversifiées, la focalisation dédiée de WUZHOU sur les tuyaux en acier spiralés garantit une expertise spécialisée et une amélioration continue précisément des produits nécessaires à l'infrastructure saoudienne.

- Échelle de production et flexibilité: Avec 11 lignes de production de tuyaux spiralés, WUZHOU peut gérer des commandes de gros volumes tout en conservant la flexibilité de produire simultanément plusieurs spécifications – un avantage critique pour les projets saoudiens complexes aux exigences variées en tuyaux.

- Assurance qualité complète: Le processus de contrôle qualité multi-étapes de WUZHOU, de l'inspection des matières premières aux essais finaux du produit, s'aligne parfaitement sur les exigences qualitatives exigeantes de Saudi Aramco.

- Capacités intégrées de revêtement: Les lignes de production dédiées au revêtement et au doublage de l'entreprise assurent un contrôle qualité fluide tout au long du processus de fabrication des tuyaux.

- Références éprouvées au Moyen-Orient: L'historique de projets réussis de WUZHOU en Arabie saoudite et dans les pays voisins démontre sa compréhension des exigences et défis régionaux.

Alors que l'Arabie saoudite poursuit la mise en œuvre de ses ambitieux plans de développement Vision 2030, des partenaires infrastructurels fiables comme WUZHOU joueront un rôle de plus en plus important dans la construction de l'avenir énergétique du Royaume. Leur combinaison d'excellence manufacturière, d'assurance qualité et d'approche centrée sur le client les positionne comme un fournisseur stratégique idéal pour le développement continu de l'infrastructure de pipelines en Arabie saoudite.

Processus d'approvisionnement : Comment importer des tuyaux SSAW de qualité en Arabie saoudite

L'importation de tuyaux en acier SSAW en Arabie saoudite pour des projets pétroliers et gaziers implique la navigation dans un processus d'approvisionnement complexe nécessitant une planification minutieuse, le respect des réglementations et l'adhésion aux normes sectorielles. Cette section fournit un guide complet pour aider les acheteurs en gros, les chefs de projet et les professionnels de l'approvisionnement à sourcer efficacement des tuyaux SSAW de qualité pour les projets saoudiens.

Planification stratégique des achats

Un approvisionnement réussi commence par une planification approfondie tenant compte des exigences du projet, des considérations de timing et des contraintes budgétaires :

- Définition des exigences et développement des spécifications :

La première étape critique consiste à créer des spécifications techniques détaillées conformes aux normes Saudi Aramco et aux exigences spécifiques du projet :

Élément de spécification Considérations clés Meilleures pratiques

Paramètres techniques Diamètre, épaisseur de paroi, nuance d'acier, longueur Consulter l'équipe d'ingénierie et vérifier par rapport aux exigences SAES

Exigences de revêtement Types de revêtement externe/interne, épaisseur Tenir compte des conditions environnementales spécifiques du site d'installation

Exigences d'essais Méthodes NDT, critères d'acceptation Aligner sur les exigences d'inspection Saudi Aramco

Documentation Certificats et rapports d'essais requis Spécifier un ensemble documentaire conforme à l'Arabie saoudite

Calendrier de livraison Dates des étapes, livraison échelonnée Prévoir un délai tampon pour le dédouanement

- Qualification et évaluation des fournisseurs :

L'élaboration d'un processus robuste de qualification des fournisseurs permet d'identifier des fabricants comme WUZHOU répondant aux exigences strictes de l'Arabie saoudite :

Critères de pré-qualification : Établir des exigences minimales incluant :

Certification API 5L

Système de management de la qualité ISO 9001

Expérience prouvée dans des projets saoudiens

Seuils minimaux de capacité de production

Indicateurs de stabilité financière

Facteurs d'évaluation technique :

Capacités des processus de fabrication

Systèmes d'assurance qualité

Installations de tests

Méthodes d'application des revêtements

Expérience spécifique à l'Arabie saoudite

Facteurs d'évaluation commerciale :

Analyse du coût total livré

Flexibilité des conditions de paiement

Dispositions de garantie

Capacités de support après-vente

Arrangements logistiques

- Processus d'appel d'offres (RFQ) :

L'élaboration d'une documentation RFQ complète garantit que les fournisseurs soumettent des propositions complètes et comparables :

Composants du RFQ :

Spécifications techniques détaillées

Exigences de quantité et calendrier de livraison

Exigences en matière d'assurance qualité

Protocoles d'inspection et d'essais

Exigences en matière de documentation

Spécifications logistiques et d'emballage

Conditions commerciales et générales

Critères d'évaluation

Conférence avec les fournisseurs :

Envisager d'organiser une réunion pré-soumissionnelle avec les fournisseurs potentiels pour clarifier les exigences techniques et répondre aux questions, particulièrement pour les commandes de gros volumes destinées à des projets d'infrastructure critiques en Arabie saoudite.

Visites sur site :

Pour des approvisionnements significatifs, organiser des visites des installations des fabricants pour vérifier de visu les capacités de production et les systèmes qualité. Cela est particulièrement important lors de l'établissement de nouvelles relations fournisseurs pour des projets saoudiens.

Considérations contractuelles pour les projets saoudiens

L'élaboration de termes contractuels appropriés est essentielle pour gérer les risques et assurer une livraison réussie :

- Dispositions contractuelles clés :

Élément contractuel Considérations spécifiques à l'Arabie saoudite Approche d'atténuation des risques

Spécifications Référence aux normes Saudi Aramco Inclure des références spécifiques aux normes SAES

Exigences de qualité Exigences d'inspection tierce Spécifier les agences d'inspection approuvées par Saudi Aramco

Conditions de livraison Incoterms adaptés aux importations saoudiennes CIF Dammam/Djeddah généralement préférés

Conditions de paiement Structures LC acceptables pour les banques saoudiennes Confirmer à l'avance avec les partenaires bancaires saoudiens

Documentation Exigences douanières saoudiennes et de conformité Spécifier la conformité SASO, SABER le cas échéant

Garantie Couverture pour les conditions d'exploitation saoudiennes Inclure des dispositions spécifiques pour l'environnement désertique

Résolution des litiges Considérations de juridiction légale saoudienne Spécifier les mécanismes d'arbitrage appropriés

- Dispositions d'assurance qualité :

Des exigences détaillées d'assurance qualité sont cruciales pour les projets saoudiens :

Droits d'inspection :

Définir l'accès à l'inspection pour le client et les tiers aux étapes clés de fabrication :

Vérification des matières premières

Surveillance du processus de production

Inspection des soudures

Application du revêtement

Essais et inspection finaux

Points de retenue :

Établir des points d'inspection obligatoires nécessitant une approbation avant poursuite :

Vérification des matériaux

Approbation de la première production de tuyau

Qualification des procédures de soudage

Qualification de la procédure de revêtement

Inspection pré-expédition

Exigences documentaires :

Spécifier l'ensemble des certificats et rapports requis :

Rapports d'essais de matériaux (MTR)

Rapports d'inspection dimensionnelle

Qualifications des procédures de soudage

Rapports NDT avec identifiants des opérateurs qualifiés

Rapports d'inspection du revêtement

Certificats d’inspection par tiers

- Gestion logistique et de livraison :

Les contrats doivent aborder les défis spécifiques à l'expédition de tuyaux de grand diamètre vers l'Arabie saoudite :

Spécifications d'emballage :

Détailer les exigences de protection pour le climat désertique :

Exigences pour les capuchons d'extrémité

Couvertures résistantes aux UV

Limitations d'empilage

Exigences de marquage d'identification

Responsabilités de transport :

Définir clairement la coordination logistique :

Exigences relatives au type de navire

Procédures de manutention portuaire

Arrangements de transport intérieur

Exigences de stockage à destination

Calendrier de livraison :

Structurer pour s'aligner sur le calendrier du projet :

Calendrier de livraison basé sur les étapes

Exigences de rapports d'avancement

Dommages-intérêts conventionnels pour retards

Dispositions relatives à la force majeure

Procédures d'importation et conformité réglementaire

La navigation dans les réglementations d'importation de l'Arabie saoudite nécessite une planification minutieuse et une préparation documentaire :

- Exigences pré-importation :

Plusieurs procédures doivent être achevées avant l'expédition des tuyaux vers l'Arabie saoudite :

Certification SABER :

Le programme d'évaluation de conformité des produits d'Arabie saoudite exige :

Enregistrement du produit sur la plateforme SABER

Certificats de conformité d'organismes reconnus

Documentation de conformité aux normes applicables

Enregistrement douanier saoudien :

S'assurer de l'enregistrement sur la plateforme Fasah des douanes saoudiennes pour une gestion électronique :

Dépôt des déclarations d'importation

Soumission de documents

Paiement des droits

Suivi des expéditions

Licence d'importation :

Pour les expéditions industrielles importantes, vérifier si des licences d'importation spécifiques sont requises via :

Ministère du Commerce

Ministère de l'Énergie

Saudi Aramco (pour les projets)

- Paquet de documentation :

Préparer une documentation complète pour faciliter le dédouanement :

Documents commerciaux :

Facture commerciale

Liste de colisage

Certificat d'origine

Lettre de voiture

Documentation de la lettre de crédit

Documents techniques :

Certificats d'essai des matériaux

Rapports d'inspection

Certificats de qualité

Rapports dimensionnels

Rapports d'inspection des revêtements

Documents réglementaires :

Certificat de conformité SABER

Approbations de l’Organisation saoudienne des normes, de la métrologie et de la qualité (SASO)

Certifications de sécurité des produits

Documentation de conformité environnementale

- Processus de dédouanement douanier :

Comprendre le processus de dédouanement saoudien permet d’éviter les retards :

Préparation avant arrivée :

Soumettre la documentation par voie électronique via Fasah avant l’arrivée du navire

Inspection douanière :

Se préparer à une éventuelle inspection physique de la cargaison :

Organiser l’accès à l’inspection au port

Disposer de représentants techniques sur place

Anticiper des prélèvements et tests aléatoires

Paiement des droits :

L’Arabie saoudite applique généralement un droit de douane de 5 % sur les tubes en acier importés, calculé sur la base de la valeur CIF

Achèvement du dédouanement :

Organiser la libération et le transport depuis le port :

Coordonner avec l’agent de dédouanement

Organiser un transport spécialisé

Préparer le site de réception pour la livraison

Collaboration avec des fournisseurs fiables comme WUZHOU

S’associer à des fabricants expérimentés comme WUZHOU permet de simplifier considérablement le processus d’importation :

- Services de soutien des fournisseurs :

WUZHOU propose un soutien complet pour les importations en Arabie saoudite :

Préparation de la documentation :

Expérience dans la constitution de dossiers documentaires conformes aux exigences saoudiennes

Conformité réglementaire :

Maîtrise des exigences SABER, SASO et Saudi Aramco

Coordination logistique :

Relations établies avec les compagnies maritimes desservant les ports saoudiens

Soutien technique :

Disponible pour consultation lors des inspections douanières en cas de questions techniques

- Processus de vérification de la qualité :

Le système de contrôle qualité de WUZHOU répond aux attentes saoudiennes :

Vérification des matières premières :

Tests complets des matériaux avec documentation

Surveillance de la production :

Contrôle qualité continu tout au long de la fabrication

Inspection par des tiers :

Coordination avec les agences d'inspection désignées par le client

Essais complets :

Tests mécaniques, dimensionnels et de performance exhaustifs

Paquet de documentation :

Préparation de dossiers qualité conformes aux normes saoudiennes

- Optimisation logistique :

WUZHOU propose un soutien logistique précieux :

Optimisation de l'emballage :

Emballage spécialisé conçu pour les conditions saoudiennes

Supervision du chargement :

Supervision experte du chargement des navires pour prévenir les dommages

Suivi des expéditions :

Mises à jour en temps réel sur l'état des expéditions

Coordination portuaire :

Intermédiation avec les agents maritimes dans les ports saoudiens

Considérations sur les délais et les coûts

Comprendre les délais et facteurs de coût typiques facilite la planification des projets :

- Délai d'approvisionnement pour les projets saoudiens :

Étape d'approvisionnement Durée typique Stratégies d'optimisation

Élaboration des spécifications 2-4 semaines Utiliser des spécifications standardisées lorsque possible

Qualification des fournisseurs 3-5 semaines Maintenir une base de données de fournisseurs préqualifiés

Processus d'appel d'offres 3-4 semaines Fournir des exigences claires et détaillées

Évaluation technique 2-3 semaines Établir des critères d'évaluation structurés

Négociation et contractualisation 3-4 semaines Préparer des modèles de contrats standards

Période de fabrication 8-16 semaines Passer des commandes avec un délai suffisant

Inspection et essais 2-3 semaines Programmer les inspections à l'avance

Expédition vers l'Arabie saoudite 4-6 semaines Choisir soigneusement les options d'expédition

Dédouanement 1-3 semaines Préparer minutieusement la documentation

Transport intérieur 1-2 semaines Prévoir un transport spécialisé

Durée totale 29-50 semaines Planification minutieuse requise

- Analyse des composantes de coût :

Comprendre la structure complète des coûts facilite l'établissement du budget et l'évaluation des fournisseurs :

Coût de base des tuyaux :

Généralement 60-70 % du coût total à l'arrivée, influencé par :

Grade d'acier et épaisseur de paroi

Spécifications de diamètre

Volume de la commande

Conditions du marché pour les matières premières

Coûts de revêtement :

Représente 15-25 % du coût des tuyaux, variant selon :

Type et épaisseur du revêtement

Exigences de préparation de surface

Exigences de performance spécifiques

Essais et inspection :

Représente 3-5 % du coût total :

Exigences CND

Essais mécaniques

Frais d'inspection par tiers

Exigences d'essais spécifiques

Transport et logistique :

Généralement 10-15 % du coût total à l'arrivée :

Fret maritime

Manutention portuaire

Droits de douane (5 % pour l'Arabie saoudite)

Transport intérieur

Documentation et conformité :

1-2 % du coût total :

Certification SABER

Certificats d'essai

Documentation qualité

Coûts de conformité réglementaire

- Stratégies d'optimisation de la valeur :

Plusieurs approches permettent d'optimiser le processus d'approvisionnement :

Consolidation des volumes :

Regrouper les besoins entre projets pour réaliser des économies d'échelle

Standardisation :

Élaborer des spécifications standardisées pour réduire la complexité de fabrication

Implication précoce :

Associer des fournisseurs comme WUZHOU dès les phases initiales du projet pour optimiser les spécifications

Accords à long terme :

Établir des accords-cadres avec des fournisseurs privilégiés pour obtenir de meilleures conditions

Coordination logistique :

Coordonner les expéditions pour maximiser l'utilisation des navires

En suivant ces directives complètes d'approvisionnement et en s'associant à des fabricants expérimentés comme WUZHOU, les chefs de projet et les professionnels de l'approvisionnement peuvent importer efficacement des tuyaux SSAW de haute qualité en Arabie saoudite tout en minimisant les risques et en optimisant les délais des projets.

Études de cas : Mise en œuvre réussie de tuyaux SSAW dans des projets majeurs pétroliers et gaziers saoudiens

L'application pratique des tuyaux en acier SSAW dans l'infrastructure pétrolière et gazière d'Arabie saoudite démontre leur efficacité et leur fiabilité dans des conditions réelles. Cette section présente des études de cas détaillées de grands projets ayant utilisé avec succès des tuyaux SSAW, y compris ceux fournis par WUZHOU, en mettant en lumière les défis rencontrés et les solutions mises en œuvre.

Étude de cas 1 : Projet d'extension du gazoduc de la province orientale

Aperçu du projet :

Détails des éléments du projet

Client Saudi Aramco

Localisation Province orientale, Arabie saoudite

Périmètre du projet 320 km de gazoduc de 48 pouces

Spécifications des tuyaux SSAW Diamètre 48 pouces, grade X70, épaisseur de paroi 18,3 mm, revêtement 3LPE

Calendrier du projet 2018-2020

Valeur du projet 850 millions de dollars (composante gazoduc)

Fournisseur SSAW WUZHOU (en consortium avec un partenaire local)

Défis du projet :

Défis techniques :

Haute pression d'exploitation (94 bars) nécessitant un contrôle qualité rigoureux

Terrain désertique avec des fluctuations extrêmes de température (0 °C à 55 °C)

Sections traversant des zones de sabkha (plaines salines) avec des conditions de sol hautement corrosives

Pression sur le calendrier nécessitant une livraison accélérée

Défis logistiques :

Grandes dimensions des tuyaux nécessitant une manutention spécialisée

Congestion portuaire à Dammam pendant la saison de pointe des importations

Sites d'installation éloignés avec un accès limité

Coordination des livraisons échelonnées avec le calendrier de construction

Mise en œuvre des solutions :

WUZHOU, en tant que principal fournisseur de tuyaux pour ce projet, a mis en œuvre plusieurs approches innovantes :

Protocoles de fabrication renforcés :

Exigences CND renforcées avec 100 % d'essais ultrasonores automatisés

Paramètres de soudage améliorés pour le matériau X70

Essais de rupture à l'échelle réelle sur des échantillons de production

Mesures spéciales de contrôle qualité pour les applications à haute pression

Système de revêtement spécialisé :

Développement d'un système de revêtement 3LPE personnalisé avec épaisseur accrue (3,2 mm)

Ajout d'une couche supérieure résistante aux UV pour un stockage prolongé en conditions désertiques

Procédures d'application spécialisées pour une meilleure adhérence

Essais de vieillissement accéléré simulant les conditions désertiques saoudiennes

Optimisation logistique :

Affrètement de navires dédiés pour éviter la congestion portuaire

Établissement d'installations de stockage temporaires près des sites de construction

Mise en place d'un système de livraison juste-à-temps coordonné avec l'avancement de la construction

Développement de procédures spécialisées de manutention des tuyaux en conditions désertiques

Soutien technique :

Déploiement de représentants techniques sur les sites d'installation

Formation spécialisée pour la manutention, le stockage et le cintrage sur site

Audits qualité réguliers pendant l'installation

Assistance technique en soudage pour les assemblages sur site

Résultats du projet :

Le projet a été achevé avec succès, marquant plusieurs réalisations notables :

Performance qualité : Zéro rejet de tuyaux pendant l'installation

Performance calendrier : Toutes les livraisons effectuées avec 2 semaines d'avance

Bilan sécurité : Aucun incident lié à la manutention ou à l'installation des tuyaux

Performance opérationnelle : Essais hydrostatiques réussis à 1,25 fois la pression de conception

Performance à long terme : Gazoduc en exploitation réussie depuis la mise en service sans problèmes d'intégrité

Enseignements clés :

L'implication précoce du fournisseur dans l'élaboration des spécifications a permis une conception optimisée des tuyaux pour les conditions spécifiques du projet.

Les mesures renforcées de contrôle qualité en fabrication ont éliminé les rejets et reprises coûteux sur site.

La planification logistique coordonnée a évité les retards malgré les conditions portuaires difficiles et les sites d'installation éloignés.

Le soutien technique pendant l'installation a assuré une manutention et des pratiques sur site appropriées, contribuant au bilan sécurité exemplaire du projet.

Le système de revêtement spécialisé a démontré d'excellentes performances pour protéger contre l'environnement désertique rude de l'Arabie saoudite.

Étude de cas 2 : Projet de gazoduc multi-produits de la région centrale

Aperçu du projet :

Détails des éléments du projet

Client Saudi Aramco et Royal Commission for Jubail and Yanbu

Localisation Région centrale, Arabie saoudite (Riyad à Qassim)

Périmètre du projet 420 km de système de gazoduc multi-diamètres

Spécifications des tuyaux SSAW Multiples diamètres (30 pouces, 36 pouces, 42 pouces), grade X65, épaisseurs de paroi variées

Calendrier du projet 2019-2021

Valeur du projet 1,2 milliard de dollars (projet total)

Fournisseur SSAW Consortium incluant WUZHOU

Défis du projet :

Complexité technique :

Exigences de transport multi-produits avec spécifications variables

Terrain rocailleux nécessitant des propriétés mécaniques renforcées des tuyaux

Zones à nappe phréatique élevée nécessitant une protection par revêtement spécialisé

Zones à considération sismique nécessitant une flexibilité accrue

Défis de mise en œuvre :

Calendrier complexe avec plusieurs fronts de construction simultanés

Exigences de diamètres variés nécessitant une flexibilité de production

Exigences strictes de contenu local dans le cadre de la Vision 2030 saoudienne

Exigences de sécurité renforcées pour les traversées de zones peuplées

Mise en œuvre des solutions :

Solutions d'ingénierie technique :

Développement de spécifications de tuyaux personnalisées pour chaque segment en fonction du produit et du terrain

Mise en œuvre d'exigences de ténacité à la fracture renforcées pour les sections rocailleuses

Conception d'un système de revêtement compatible avec la protection cathodique pour les zones à nappe élevée

Utilisation d'une chimie d'acier optimisée pour une meilleure soudabilité sur site

Approche de fabrication :

Production parallèle de multiples diamètres pour répondre aux exigences de livraison échelonnée

Essais spécialisés de ténacité à l'encoche pour les sections critiques

Protocoles de contrôle qualité renforcés pour les spécifications variables

Documentation qualité spécifique aux lots pour la traçabilité

Création de valeur locale :

Partenariat établi avec un distributeur saoudien pour la manutention locale des tuyaux

Transfert de connaissances par formation technique du personnel local

Élaboration de procédures d'installation détaillées adaptées aux conditions locales

Création de supports techniques en langue arabe

Gestion de projet :

Mise en place d'un système de suivi numérique pour un suivi en temps réel de la production et des livraisons

Réunions de coordination hebdomadaires avec les équipes de construction

Calendrier de livraison flexible pour accommoder les changements de construction

Système de gestion documentaire complet pour les processus d'approbation

Résultats du projet :

Le gazoduc multi-produits a été achevé avec succès, marquant plusieurs réalisations significatives :

Performance technique : Tous les tuyaux ont respecté ou dépassé les spécifications avec des essais hydrostatiques réussis du premier coup

Performance calendrier : Livraisons échelonnées conformes au calendrier accéléré

Impact sécurité : Zéro incident de sécurité lié aux matériaux ou à l'installation des tuyaux

Impact économique : Le projet a créé plus de 500 emplois locaux grâce à la structure de partenariat

Excellence opérationnelle : Système en exploitation à pleine capacité depuis la mise en service sans problèmes d'intégrité

Enseignements clés :

La flexibilité de la fabrication des tuyaux SSAW a permis une production efficace de multiples diamètres et spécifications, essentielle pour les systèmes multi-produits complexes.

La coordination renforcée entre le fournisseur et les équipes de construction a permis d'optimiser les calendriers de livraison, réduisant les besoins de stockage sur site et les coûts de manutention.

Les solutions techniques adaptées aux conditions de terrain spécifiques ont simplifié l'installation et amélioré les performances à long terme.

Les partenariats locaux ont contribué à atteindre les objectifs de la Vision 2030 tout en garantissant l'expertise technique tout au long du cycle de vie du projet.